An account number is a unique code composed of numbers, letters, or other characters, and is assigned to the account owner for ease of reference in a financial institution’s accounting records. Small banks generally possess just one routing number, while large multinational banks can have several different ones, usually based on the state in which you hold the account. Routing numbers are most commonly required when reordering checks, for payment of consumer bills, to establish a direct deposit (such as a paycheck), or for tax payments.

- For example, hackers can still gain unauthorized access to accounts when they get authentication elements.

- Assigning a unique credit card number makes it easier to replace a lost or stolen credit card without affecting the cardholder’s bank account, and it can also help prevent fraud.

- Account numbers are like customer IDs or fingerprints specific to each accountholder.

- Anyone can locate a bank’s routing number, but your account number is unique to you, so it is important to guard it, just as you would your Social Security number or PIN code.

Suppose our business has two divisions, the semiconductor division and the mobile division, and wants to be able to identify its expenses between the two. All other account types (assets, liabilities, equity, and revenue) are not separated and are to be recorded in a default code referred to as the Head Office division. The two digit division codes allocated are Semiconductor Division 03, and Mobile Division 04 with the default division for all other entries being the Head Office Division 00. When you look at the front of a check, you’ll see a row of numbers at the bottom.

How a Bank Account Number Works

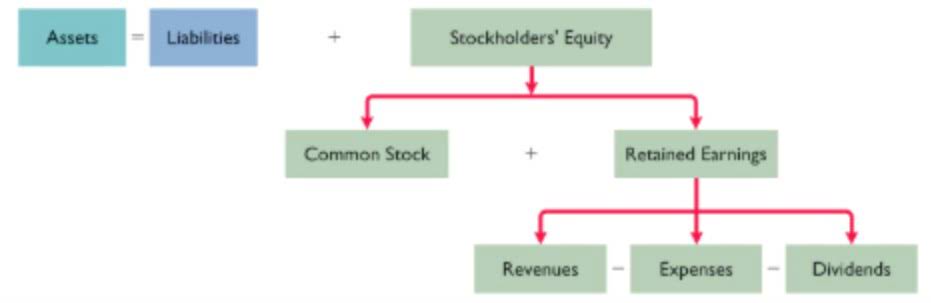

Routing numbers are issued only to federal- or state-chartered financial institutions eligible to maintain an account at a Federal Reserve Bank. If two banks merge, or one bank acquires another, the applicable routing numbers may change. Suppose the business has two departments, a production department and a marketing department, and wants to be able to identify its expenses between the two. All other account types (assets, liabilities, equity, and revenue) are not separated and are to be recorded in a default code referred to as the General department. The two digit department codes allocated are the Production Department 01, and the Marketing Department 02 with the default department being the General Department 00.

An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts. You can find your bank account number on your monthly bank statement, or by visiting a branch of your bank. These are just some of the means of protecting users’ bank account numbers in an increasingly vulnerable online environment.

Find The Best High-Yield Savings Accounts Of 2024

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. As you will see, the first digit might signify if the account is an asset, liability, etc. The first four digits of a routing number are called the Federal Reserve Processing Symbol. While your account number alone is not enough to access your funds, it’s essential to keep it secure. If combined with other personal information, it could be used maliciously.

Be prepared to provide proof of identity to verify your status as the account owner first. This may mean supplying your Social Security or driver’s license number or answering one or more security questions. The U.S. is the only country that uses ABA routing numbers to identify banks when sending and receiving money.

What is an Account Number and how is it useful?

For some, the easiest place to track down a bank account number is at the bottom of a check. In particular, if you open up your checkbook and look at the bottom of your checks, the checking account number is almost always describe the two parts of an account number the second set of numbers from the left. This is all designed to ensure that both computer systems and people working at financial institutions are clear on where the money in a transaction is going or coming from.

Malware, an account recovery procedure, or phishing are some means for intercepting such data. As a result, modern firms strive to protect consumers’ account details in an increasingly dangerous internet world. Accounts that use multi-factor authentication, which adds a second security layer to safeguard an account, are becoming more common. The Federal Reserve District Office head branch, which the bank is a part of, is indicated by these numerals. Ultimately, it will examine how these numbers are gradually being replaced by more advanced security and verification procedures that are less prone to mistakes and fraud.

Is your debit card number the same as your account number?

It’s important to ensure you correctly enter your bank ABA and account numbers. Entering an incorrect routing or account number could result in money being sent to or received by the wrong account. Double-checking each set of numbers in situations where you’re required to share them for a financial transaction can help avoid banking headaches. Another possible way to find your bank account number online is by downloading a copy of your electronic or paper statement.

- It allows you to enjoy the conveniences of modern banking while bridging the gap between virtual and physical monetary transactions.

- This system dates back to 1910 and was developed initially as a way to help bank clerks sort through piles of checks and assign them to the correct drawer.

- The 16-digit debit card number found on your physical debit card is not the same as your account number.

- If two banks merge, or one bank acquires another, the applicable routing numbers may change.

- It explains why a series of annoying questions constrain the routine change of an account number.

- It’s paired with other vital information, like the sort code or routing number, to facilitate a wide range of transactions such as wire transfers, direct deposits, and automated bill payments.

- Customers, for example, must enter biometric data, voice activation, or a time-sensitive code received to their email or mobile phone to access their accounts.