You can also hook up your Money App accounts in buy to typically the apps of which mortgage an individual money—Chime, MoneyLion, Dave, and others—to move the funds back again plus out. It’s not of which different through your own traditional payday loans—but the curiosity costs are usually very much lower. GOBankingRates’ editorial group is usually dedicated in order to getting a person neutral evaluations in add-on to information.

Q: Exactly How Several Occasions Can You Borrow From Funds App?

You can be eligible upward to become in a position to $700 of your paycheck per pay time period if a person signal upward regarding its Credit Score Builder In addition system regarding Free (or $1 to $5 regarding RoarMoney account) a calendar month. Plus you may possibly meet the criteria with respect to up in order to $1,1000 when an individual arranged upwards immediate downpayment to a RoarMoney account. 1 edge regarding MoneyLion will be its several individual financing characteristics, which usually could help members better handle their own funds plus attain their particular monetary targets. However, it’s worth observing of which you want a MoneyLion bank accounts to become in a position to entry increased money advancements. Furthermore, funds advances might consider longer to become capable to procedure as in contrast to all those regarding some other related programs.

- Brigit is a money application together with about three pricing divisions, which include a totally free variation.

- Inside overview, the particular borrow alternative is presently limited in availability as Funds App carries on to pilot in inclusion to test typically the feature.

- Finder.apresentando is a great independent evaluation program in inclusion to information service that will seeks to become in a position to provide a person with typically the resources a person need in buy to help to make much better decisions.

- In Order To be eligible regarding Chime’s solutions, you must possess immediate debris regarding at least $200 in the previous thirty days plus a good active Chime Visa for australia charge card.

- Furthermore, fresh users are usually assigned at $100 for their particular first money advance.

Money Advance Apps That Job Along With Paypal

Sure, a person can link multiple money advance applications in buy to your current Chime accounts at once. However, controlling multiple improvements and repayments can end upward being challenging, therefore keeping monitor associated with your current commitments is crucial to prevent monetary problems. The interest level depends upon factors such as typically the loan sort, repayment expression, credit rating rating, personal debt responsibilities, in add-on to earnings. 1 of many helpful life hacks regarding cellular loans is of which an individual can merely prequalify for a funds advance — it’s 100% free and protected.

- Counting only about Cash App Borrow regarding credit-building functions might not really provide the range that will lenders usually appearance for any time evaluating creditworthiness.

- Money advance programs offer a fast, low-cost alternate to payday loans, yet choosing typically the correct one depends about your own special requires.

- We All tend not to advise certain items or suppliers, on the other hand may possibly get a commission from the particular companies all of us promote in inclusion to function.

- Presently There usually are a large selection regarding money advance programs upon typically the market today, in add-on to the majority of make the particular advance process as simple as coming into your own market info and connecting your own lender bank account.

Along With the particular Chime SpotMe feature, an individual can include a huge snafu with out splitting a perspire. However, a person ought to note of which Dork doesn’t allow a person in buy to automatically exchange cash through your own Cash Application in purchase to your own Dork Investing credit card. Transfers could also get up to end upward being able to five business days and nights along with this specific cash advance services.

Typically The expense associated with FloatMe is usually comparatively reduced, at only $2 each calendar month, generating it a good inexpensive in inclusion to hassle-free choice regarding anybody looking to handle their own budget even more efficiently. If you’re continue to uncertain, an individual can try FloatMe regarding free with regard to 30 days, together with zero obligation to continue making use of typically the app when you’re not pleased. It is important to end upwards being capable to note that when the grace time period comes to a end, typically the interest price boosts to just one.25 pct for each 7 days, which usually may quickly put upwards if the particular mortgage is usually not necessarily compensated off in a well-timed method. To prevent virtually any additional costs, it is advised to pay off the particular mortgage equilibrium inside typically the four-week period of time. On Another Hand, One@Work offers a few disadvantages that an individual need to think about before using it. Very First, accessing earned funds earlier could business lead to be able to bad spending practices, plus an individual may finish up borrowing even more as in contrast to you require.

- An Individual don’t possess in purchase to wait around right up until summer to host a garage purchase; a person may offer all of them on sites just like auction web sites, Craigslist, Poshmark, or Fb Market Place to be in a position to make extra cash.

- Just Before turning to be able to a funds advance software, consider choices such as loans through family members plus close friends.

- In inclusion to giving cash advances upward to become able to $250 per pay period, it provides a combine associated with preserving, trading in addition to cost management tools that could aid you conserve.

- Picking an expedited withdrawal rather associated with a common 1 could also subject matter customers to a network fee.

What Will Be A Funds Advance About A Credit Score Card?

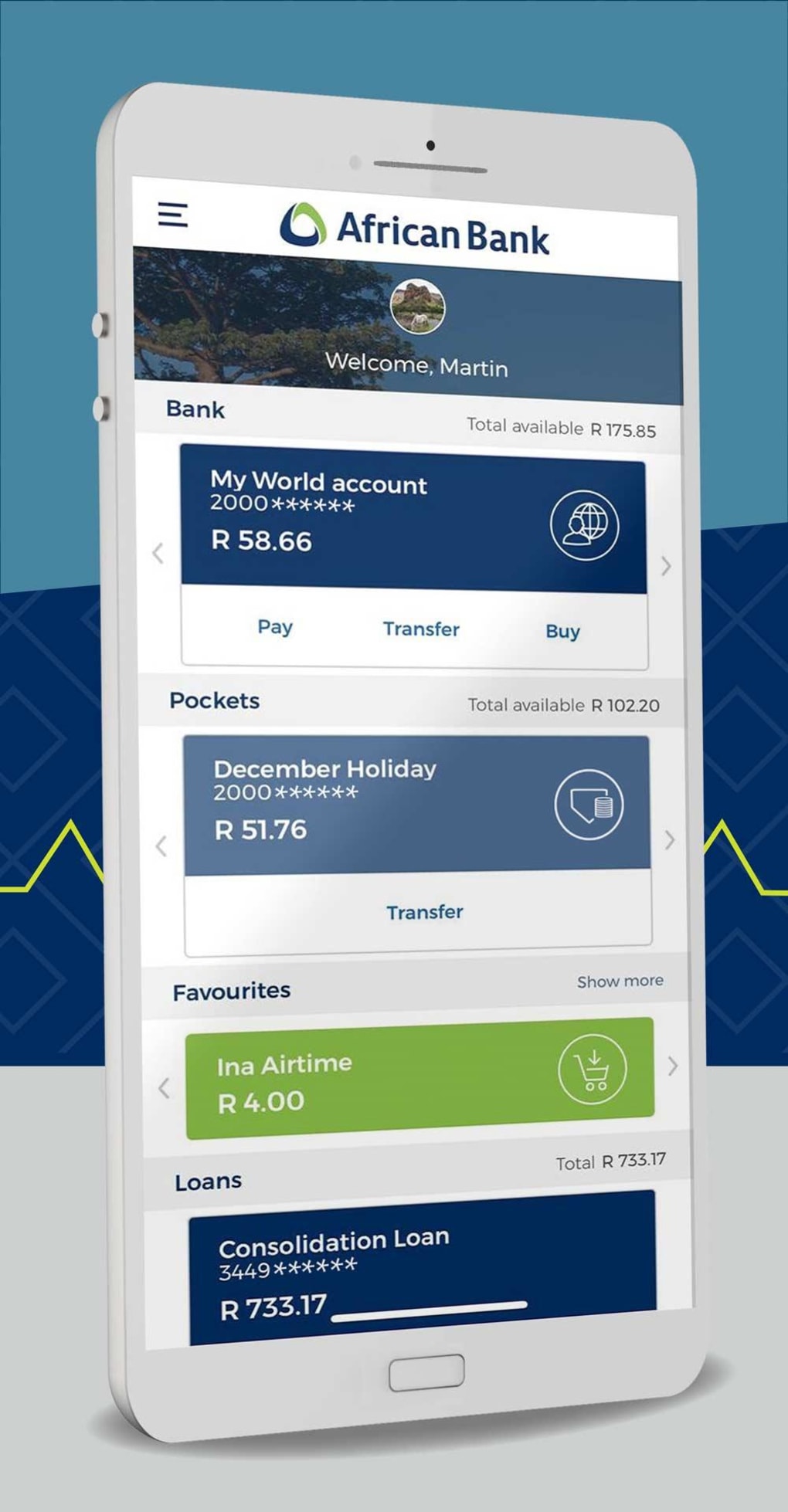

This Specific weblog will supply a comprehensive review regarding exactly how an individual may make use of a cash application regarding credit score credit card money advancements, along with its benefits plus choices. Cash Software will be ideal regarding customers that want a totally free approach in order to instantly deliver and obtain repayments. Merely link a lender accounts or upload money to become capable to Cash Application in order to send out repayments to any person within the US or UNITED KINGDOM.

- Funds advance apps are a great option any time you’re operating short about cash.

- Klover is a great app of which gives a good instant cash advance without demanding a credit verify, charging curiosity, or imposing hidden charges.

- Here usually are a pair of alternatives to end upwards being in a position to borrowing money with money advance applications.

- A Single of FloatMe’s best functions is usually that will it gives Floats, which often usually are essentially money advances of which an individual may request upward in order to $50 in buy to protect any type of surprise costs until payday.

- Regular Membership will be simply $5.99 a month and contains extra characteristics for example credit rating coaching in inclusion to personalized savings targets.

- In Order To move money coming from Funds Software to become capable to your Money Lion bank account, you will need in buy to connect MoneyLion debit card.

Beem likewise fees an unusual $5 late fee if your own automatic monthly registration fee isn’t produced. No some other funds advance app we’ve evaluated fees a late charge, in add-on to typically the borrow cash app charge is usually oddly described during the sign-up procedure. Beem will not provide a repayment date when a person take out there a good advance, neither give an individual the particular ability in buy to set one.

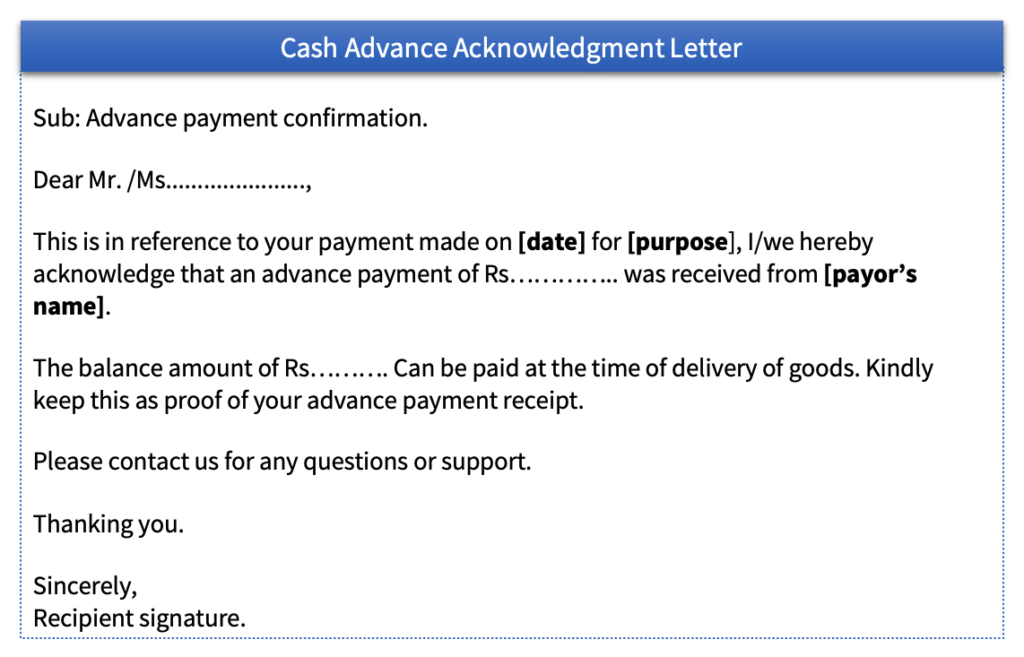

However, it’s crucial in buy to cautiously evaluation the terms, understand the particular repayment schedule, and just borrow what an individual could pay for to be able to pay back about period. As with any financial loan, it’s important to employ typically the Funds Software Borrow feature reliably to prevent possible unfavorable impacts about your budget. KashKick will be a hugely well-liked service that will enables you earn funds with regard to actively playing video games, finishing surveys, signing up for test gives plus more. (You’ll actually generate money regarding merely doing your current profile!) A Person can earn funds these days and withdraw your current earnings via PayPal as soon as you’ve reached $10.

Seeking a great Albert Quick funds advance requires a connected lender account with a charge card. Your Current limit may enhance along with on-time repayments in addition to will be influenced simply by your current loan repayment history. Prepaid playing cards in inclusion to money cards usually are not necessarily supported simply by Albert Instant due to the fact they will absence typically the required features regarding getting in inclusion to repaying payday loans. Basically reveal your targets, in addition to Genius will generate a customized expense program centered on your current chance level in inclusion to timeline.

Exactly How Several Credit Score Builder Loans May A Person Have In A Time?

To End Upward Being In A Position To use Dave with regard to money advances an individual may send out to be able to Cash Software or other balances, you’ll want to become capable to pay a monthly account payment (though the particular specific expense isn’t disclosed). Rather, Klover securely links to be capable to your financial institution bank account by way of Plaid in inclusion to evaluates your current current purchases in purchase to figure out when an individual qualify with respect to a money advance in add-on to in buy to set your current borrowing limit. These criteria can become difficult in purchase to meet in case a person don’t possess a conventional wage career, thus Klover isn’t typically a fantastic option for funds advancements with consider to gig employees. Additionally, Klover doesn’t take self work income or government benefits. It’s a great online financial institution providing different economic solutions, including spending balances, cost savings balances, in add-on to credit-building resources. While it doesn’t provide immediate money advance providers, an individual could link it in order to the particular cash advance applications we all mentioned.

Does Apple Credit Card Demand Interest About Cash Advances?

Secondly, an individual must prove of which an individual possess direct down payment inside the similar accounts. Thirdly, you should offer proof of a stable revenue regarding at minimum the last 62 times through typically the exact same employer. Finally, a person need to prove that will you have got funds inside your current bank account 24 hours right after payday. In Buy To make this particular listing, all of us seemed at all the money advance apps of which job with GO2bank plus assessed every based about their financial loan restrictions, fees, turn-around moment plus additional features. When an individual usually don’t struggle together with bills, making use of a funds advance software can make perception inside an crisis. Typically The problem will be any time a person want to become capable to rely on cash advancements or overdraft security frequently.

Employee Benefit Funds Advance Applications

This app’s rankings are 4.six about Yahoo Perform and some.Several upon the Software Retail store. General, many customers such as exactly how the overdraft security helped them prevent costs, plus other folks appreciate the early direct down payment entry. A Few Google android in addition to iOS customers usually are disappointed with consumer service’s responses to be capable to concerns and slow transfers to end upwards being able to their Existing balances. EarnIn offers regular ratings of some.six upon Search engines Play and 4.Several upon the Application Retail store.